Last year, taxpayers saw the phase-out of pandemic-era tax breaks and the return to pre-COVID amounts for popular credits like the earned income tax credit and child tax credit.

Besides the IRS’s paper backlog and confusion around reporting payments from apps like Venmo and PayPal, last tax season was more of a return to normal.

Here are some things to know for this filing season, which kicks off Jan. 29.

Full coverage: Taxes 2024 — Everything you need to file your taxes on time

Credit amounts for children and other dependents

Last year, the amounts of the child tax credit (CTC) and earned income tax credit (EITC) returned to pre-COVID levels — meaning less money back for taxpayers.

The child tax credit remains $2,000 per child (or qualifying dependent) for the 2023 tax year and is partially refundable, which means taxpayers won’t receive the full credit if it’s larger than the tax they owe.

The other dependent care (ODC) credit is for older children and aging parents who are dependents that don’t qualify under the child tax credit. It has a maximum value of $500.

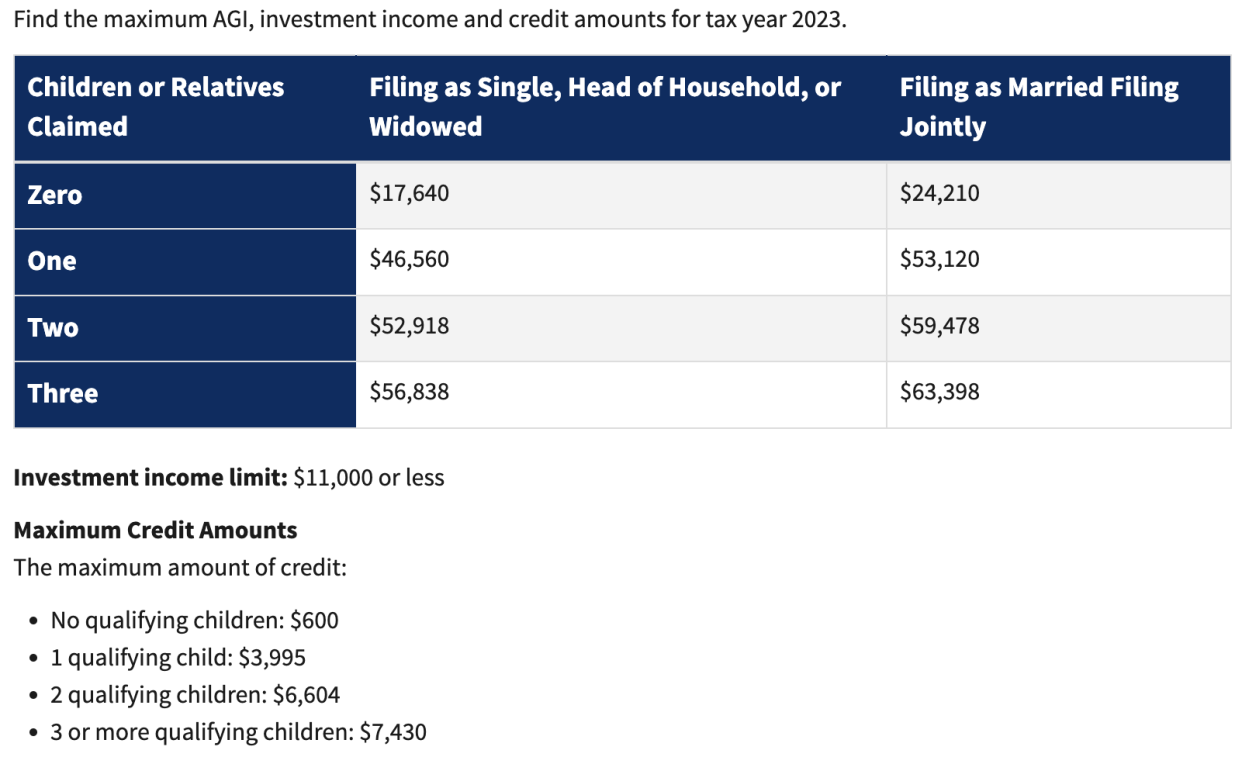

The EITC, which gives a tax break to low- and moderate-income families, has been adjusted for inflation, so there’s an increase for taxpayers. It's worth a maximum of $7,430 for families with three or more children.

Read more: How to determine if you qualify for the Earned Income Tax Credit

Student loan interest deduction and taxes for forgiveness

Student loan payments resumed this fall, so you may be eligible to deduct the interest.

"Federal student loan borrowers who were required to continue student loan payments starting in the fall of 2023 could qualify to deduct up to $2,500 of student loan interest per tax return per tax year," Kathy Pickering, chief tax officer at H&R Block, told Yahoo Finance.

Taxpayers who had their student loans forgiven in 2023 may face tax liability.

Read more: Will I be taxed on student loan forgiveness?

A provision of the American Rescue Plan made federal taxes on forgiven student loan debt exempt through 2025. However, borrowers may be on the hook for state taxes if their state hasn’t adopted that provision.

Arkansas, Indiana, Mississippi, North Carolina, and Wisconsin do not conform with the federal tax exemption on student loan forgiveness, so borrowers who had loans forgiven living in those states may be subject to state taxes.

Taxpayers should consult with their tax professional to see if they are required to pay state taxes on any student loan debt forgiven last year and what documentation, like a 1099-C, is required from their loan service provider.

Crypto, NFT, and payment-app reporting requirements

Last year, the 1099-K reporting requirement caused confusion. It required third-party payment networks, like PayPal and Venmo, to send taxpayers Form 1099-K if they received third-party payments for goods and services exceeding $600. The previous threshold was $20,000 with over 200 transactions.

The confusion stems from the nature of the transactions. Money received from friends and relatives as personal gifts or as a way of splitting restaurant bills, for example, is not taxable income. Income tax does apply to goods sold or services provided through a side gig or small business.

To avoid further confusion, the IRS again delayed implementation of the lower $600 threshold for the 2023 tax year.

"People that are not in a real business will not have an unnecessary compliance requirement," Robert Seltzer, a certified public accountant (CPA) at Seltzer Business Management, told Yahoo Finance.

Taxpayers who made cryptocurrency and NFT transactions also have a reporting requirement. Last year, taxpayers were required to answer a digital asset question and report all digital asset-related income. This year the question has been reworded and is also applicable for tax returns for trusts and estates.

"The IRS has been focusing on reporting requirements for transactions involving cryptocurrencies or NFTs, and taxpayers should ensure proper reporting to avoid penalties," Karla Dennis, an enrolled agent at Karla Dennis & Associates, told Yahoo Finance.

If your digital asset had losses, you could deduct some of those losses if you sold the coins, reducing your taxable income and potentially increasing your tax refund.

Those losses can first be used to offset any capital gains you may have. If the losses exceed the gains, taxpayers can deduct up to $3,000 in capital losses per tax year against ordinary earned income, such as wages, salaries, and business income.

The IRS also allows taxpayers to carry forward any remaining capital losses indefinitely into the future, with the limit of net $3,000 capital loss per year.

Home office deductions

Working from home increased during the pandemic, and hybrid work schedules are becoming a norm.

Just because you work from home doesn’t mean you're entitled to deduct your home office.

"Taxpayers who have been working remotely should be aware that the home office deduction is generally available only to self-employed individuals, not to employees," Dennis said.

To qualify for the deduction, you must use your home office exclusively and regularly for business. That means if you work at your dining room table — but also eat family meals there — that space can't be used for this deduction.

Read more: Home office deduction: Who can claim it, and how much can you save?

Tax day

Tax season starts Jan. 29 and the deadline to file is April 15.

However, taxpayers living in Maine or Massachusetts have until April 17 to file due to Patriots' Day and Emancipation Day.

Taxpayers in a Federal Emergency Management Agency-declared disaster relief zone are eligible for the extended deadline. For example, Connecticut taxpayers affected by the January storms have until June 17 to file.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on X @writesronda

Read the latest personal finance trends and news from Yahoo Finance.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn

As a seasoned expert in taxation and financial matters, my in-depth knowledge stems from years of hands-on experience and a continuous dedication to staying abreast of the latest developments in the field. I have navigated through complex tax codes, interpreted intricate regulations, and provided valuable insights to individuals and businesses alike. My expertise extends to various aspects of taxation, including credits, deductions, and reporting requirements.

In the article you presented, the focus is on the upcoming tax season, specifically highlighting key aspects that taxpayers need to be aware of. Let's delve into the concepts covered in the article:

-

Child Tax Credit (CTC) and Earned Income Tax Credit (EITC):

- The CTC and EITC amounts returned to pre-COVID levels last year, meaning taxpayers may receive less money compared to the pandemic era.

- The CTC remains at $2,000 per child for the 2023 tax year and is partially refundable.

- The EITC, designed to benefit low- and moderate-income families, has been adjusted for inflation, with a maximum value of $7,430 for families with three or more children.

-

Other Dependent Care (ODC) Credit:

- This credit, with a maximum value of $500, is aimed at older children and aging parents who don't qualify under the Child Tax Credit.

-

Student Loan Interest Deduction and Taxes for Forgiveness:

- Federal student loan borrowers who resumed payments in the fall of 2023 may be eligible to deduct up to $2,500 of student loan interest per tax return.

- There may be tax liability for taxpayers who had their student loans forgiven in 2023, particularly at the state level. Some states, like Arkansas and Wisconsin, do not conform with the federal tax exemption on forgiven student loan debt.

-

Crypto, NFT, and Payment-App Reporting Requirements:

- Reporting requirements for transactions involving cryptocurrencies or NFTs are emphasized.

- The 1099-K reporting requirement for third-party payment networks (e.g., PayPal, Venmo) was confusing last year, prompting the IRS to delay the implementation of the lower $600 threshold for the 2023 tax year.

- Taxpayers involved in cryptocurrency and NFT transactions need to ensure proper reporting to avoid penalties.

-

Home Office Deductions:

- The article cautions that the home office deduction is generally available only to self-employed individuals, not employees.

- To qualify for the deduction, one must use the home office exclusively and regularly for business purposes.

-

Tax Day Information:

- The tax season for 2024 kicks off on January 29, with the filing deadline on April 15. However, taxpayers in Maine or Massachusetts have until April 17 due to Patriots' Day and Emancipation Day.

- Individuals in FEMA-declared disaster relief zones may be eligible for an extended deadline.

Armed with this knowledge, taxpayers can navigate the upcoming filing season with confidence, maximizing their eligible credits and deductions while ensuring compliance with reporting requirements.